exxon shares outstanding

Tons of financial metrics for serious investors. Exxon 2021 shares outstanding were 4275B a 009 increase from 2020.

Exxon Mobil Stock Q4 And Full Year 2021 Complete Analysis Nyse Xom Seeking Alpha

Compare XOM With Other Stocks.

. Start your Free Trial Shares outstanding are shares that have been authorized issued and purchased by investors and are held by them. Get shares outstanding charts for Exxon Mobil XOM. Exxon annual basic shares outstanding for 2021 were 4275B a 009 increase from 2020.

- USA Stock USD 9759 095 098 For Exxon profitability analysis we use financial ratios and fundamental drivers that measure the ability of Exxon to generate income relative to revenue assets operating costs and current equity. Exxon annual basic shares outstanding for 2020 were 4271B a 002 increase from 2019. Woods had argued that Exxons board understood the companys complexity and that Exxon.

First-quarter results included an unfavorable identified item of 34 billion associated with our planned exit from Russia Sakhalin-1 or 079 per share assuming dilution. 2022 View and export this data going back to 1920. Exxon shares outstanding for the quarter ending March 31 2022 were 4266B a 014 decline year-over-year.

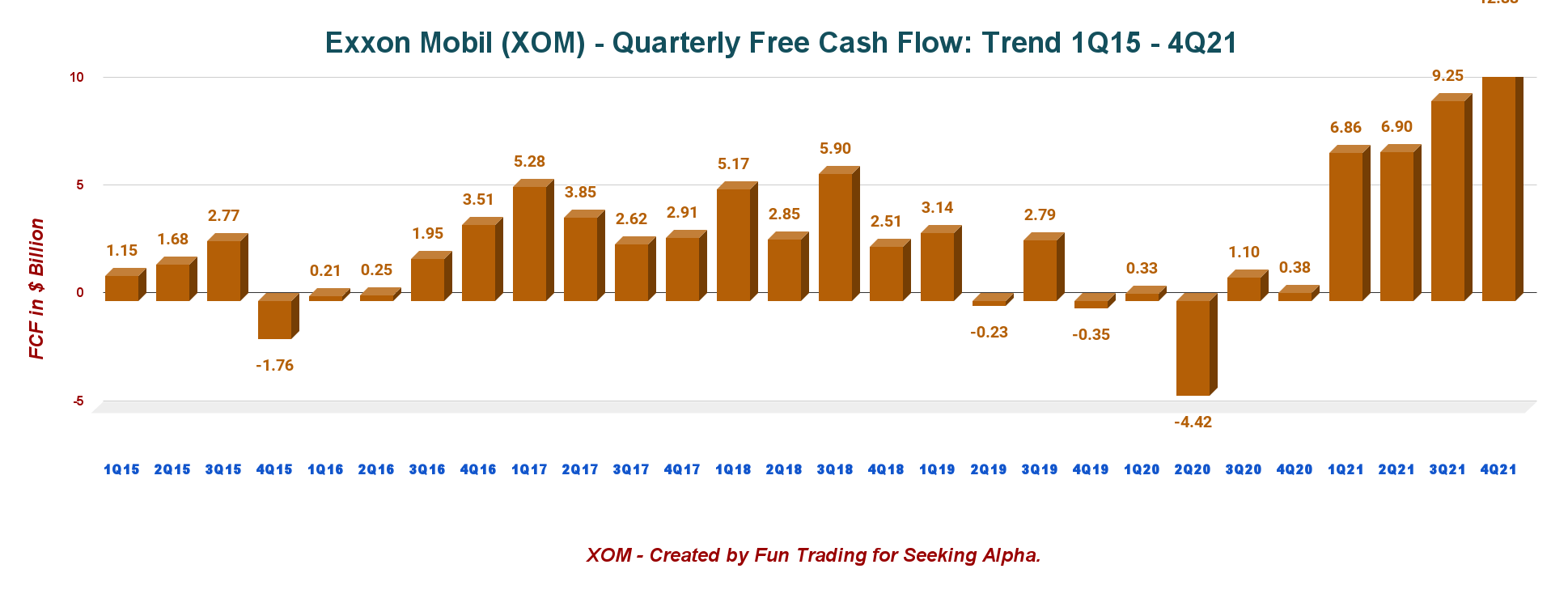

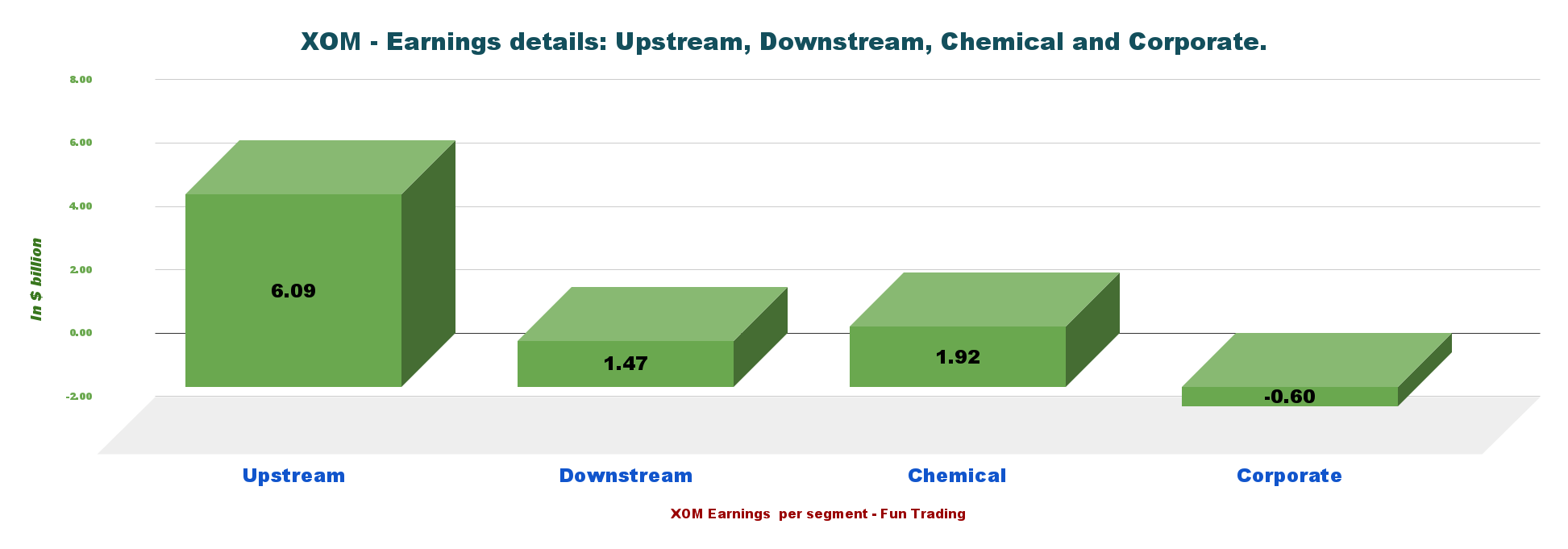

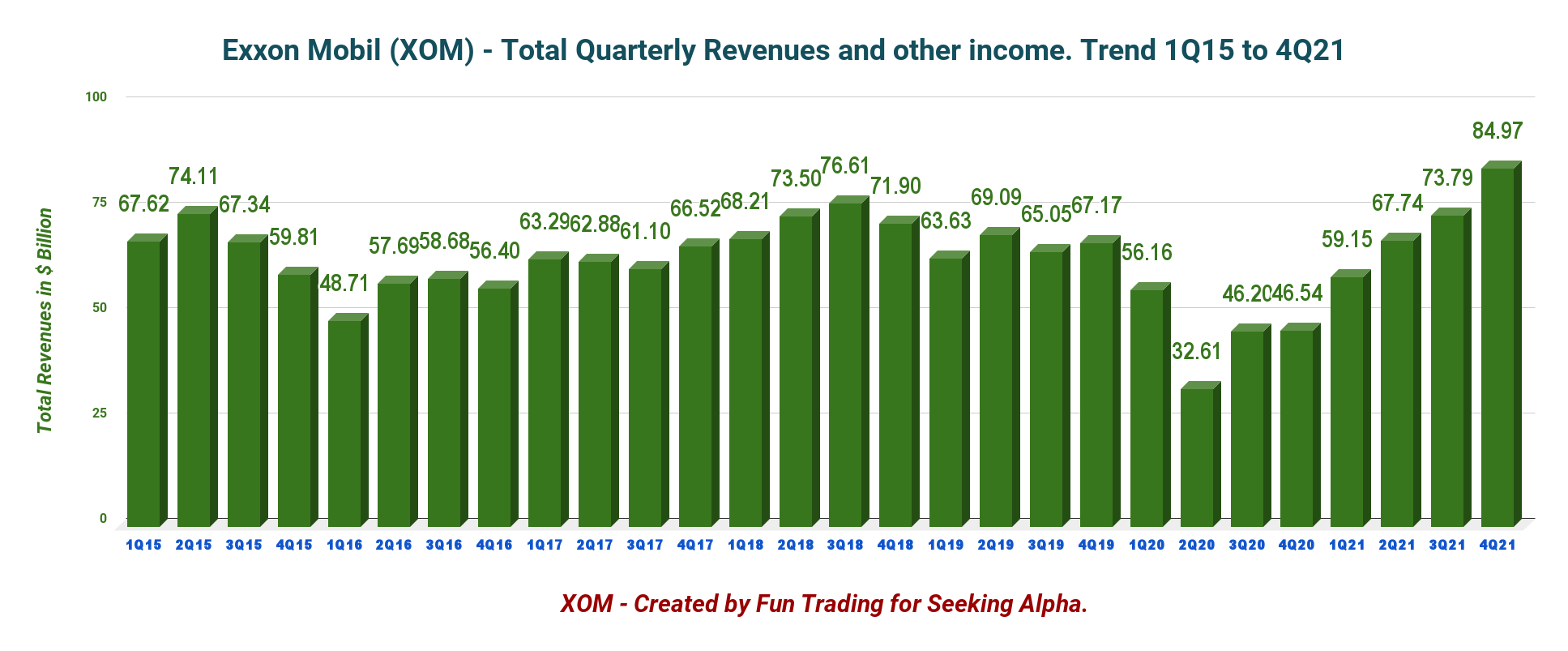

Exxon basic shares outstanding for the twelve months ending March 31 2022 were 17093B a 005 increase year-over-year. ExxonMobil earns 23 billion in 2021 initiates 10 billion share repurchase program IRVING Texas February 1 2022 Exxon Mobil Corporation today announced fourth-quarter 2021 earnings of 89 billion or 208 per share assuming dilution resulting in full-year earnings of 23 billion or 539 per share assuming dilution. Revenue matched expectations and earnings exceeded them.

Exxon Mobil Shares Outstanding Diluted Average. Exxon 2019 shares outstanding were 427B a 0 decline from 2018. Exxon Mobil Shares Outstanding Diluted Average as of today March 22 2022 is 855 Mil.

9 The company is primarily a mutual fund and ETF management company with. In depth view into BUEXOM Shares Outstanding Diluted Average explanation calculation historical data and more. Find out all the key statistics for Exxon Mobil Corporation XOM including valuation measures fiscal year financial statistics trading record share statistics and more.

Exxon Mobil Corp 0R1MLSE set a new 52-week high during todays trading session when it reached 9208. View Exxon Mobil Corporations Shares Outstanding trends charts and more. Data delayed at least 20 minutes as of Jun 27 2022 1914 BST.

26 rows Shares Outstanding Definition The volume of stock shares issued by. Watchlists Ideas Screener Data Explorer Charts Saved Work. Biggest Companies Most Profitable Best Performing Worst Performing 52-Week Highs 52-Week Lows Biggest Daily Gainers.

Financials Stock Price Assets Cash and Equivalent Cost of Sales Current Assets Current Liabilities Debt Dividend Yield EBIT. Exxon Mobils shares outstanding is 4234 billion. Get the tools used by smart 2 investors.

Exxon Mobil reported 421B in Outstanding Shares in June of 2022. 100 free no signups. Exxon Mobils PEG ratio is 173.

Valuation Ratios The trailing PE ratio is 1447 and the forward PE ratio is 938. Exxon Mobil has 421 billion shares outstanding. Exxon Mobil Shares Outstanding.

IRVING Texas April 29 2022 Exxon Mobil Corporation today announced estimated first-quarter 2022 earnings of 55 billion or 128 per share assuming dilution. H1ES34 94 M1RO34 48 COPH34 40 NS 34 BKEP 29 SP500 00 DOW -06 FTSE 100 -02. A 42 stock price increase in 20 years equates to annual returns of 18.

The number of shares has increased by 000 in one year. XOM reported 85 billion in revenue and earned an adjusted 88 billion or 205 per share. Over this period the share price is up 3998.

4266 Mil As of Mar. View 4000 financial data types. We returned 58 billion to shareholders of which about two-thirds was in the form of dividends and the remainder share repurchases consistent.

Get 20 years of historical shares outstanding charts for XOM stock and other companies. Exxon shares rose 12 to 5894 on the day. In fact shares of Exxon Mobil Corporation only rose by 42 since June 2001 when the last stock split occurred and today.

Financial Ratio History Enterprise Valuation The stocks EVEBITDA ratio is 665 with a EVFCF ratio of 1008. The stock has lagged its peers over the last five years. BlackRock owns 2833 million shares of ExxonMobil representing 66 of total shares outstanding as of February 2022.

Exxon 2020 shares outstanding were 4271B a 002 increase from 2019. 4234B for June 30 2021.

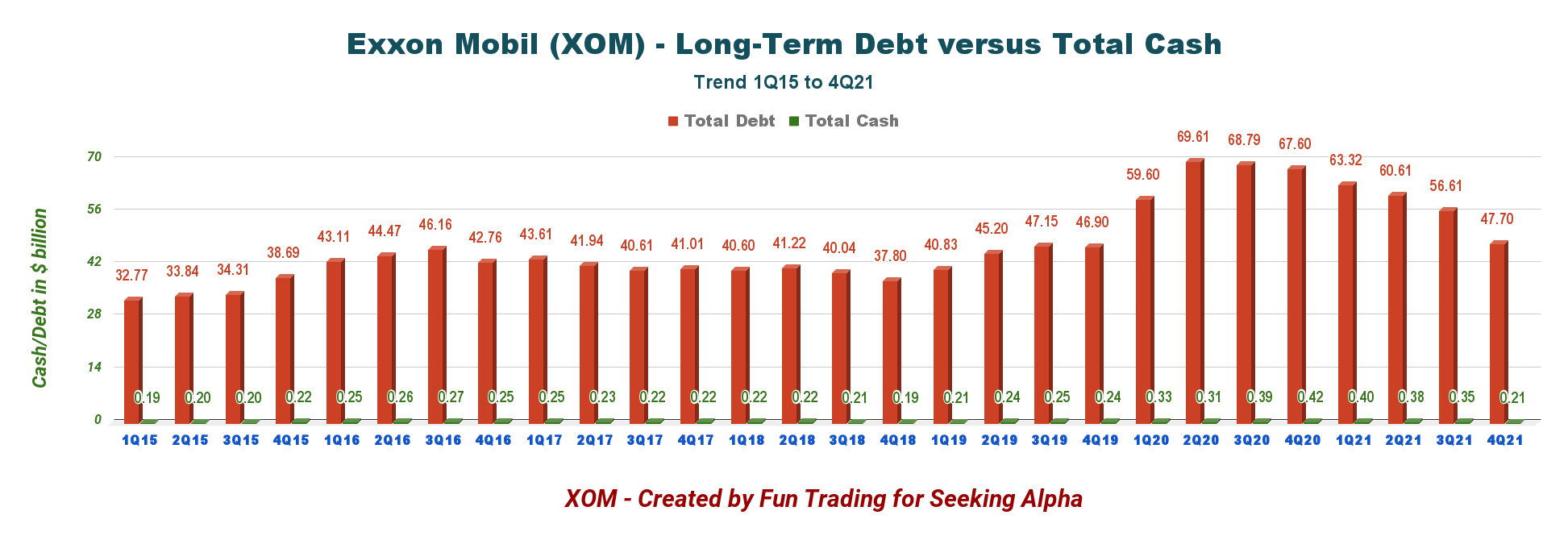

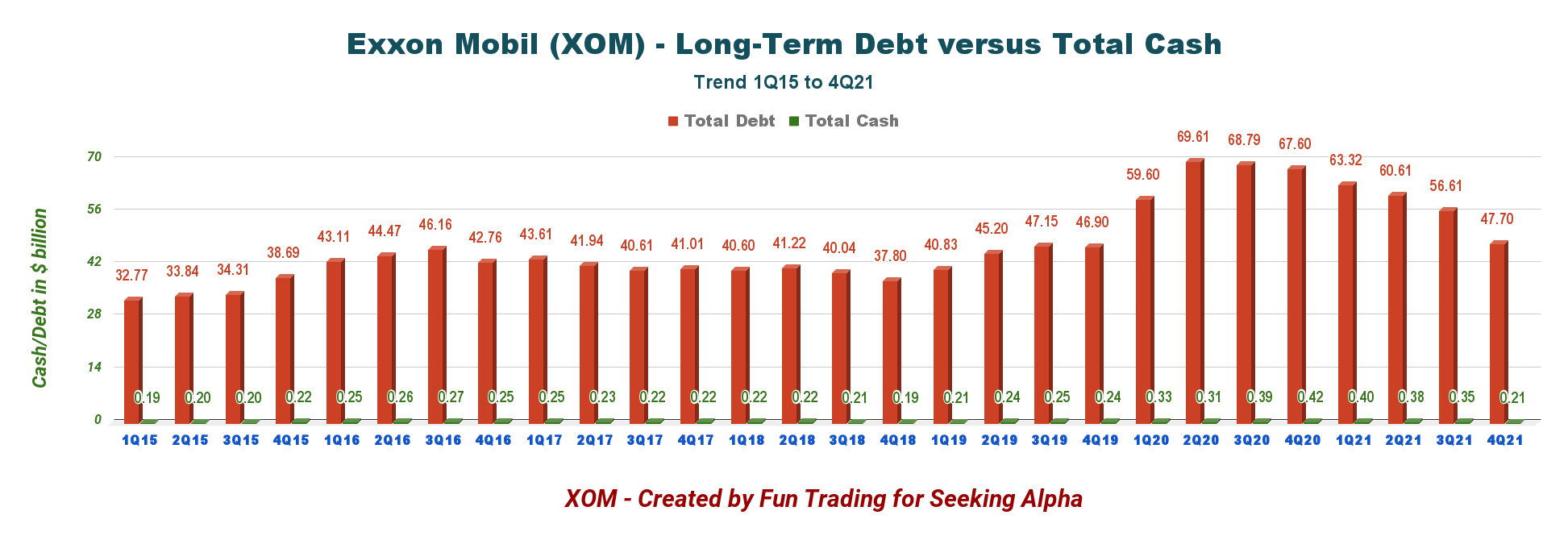

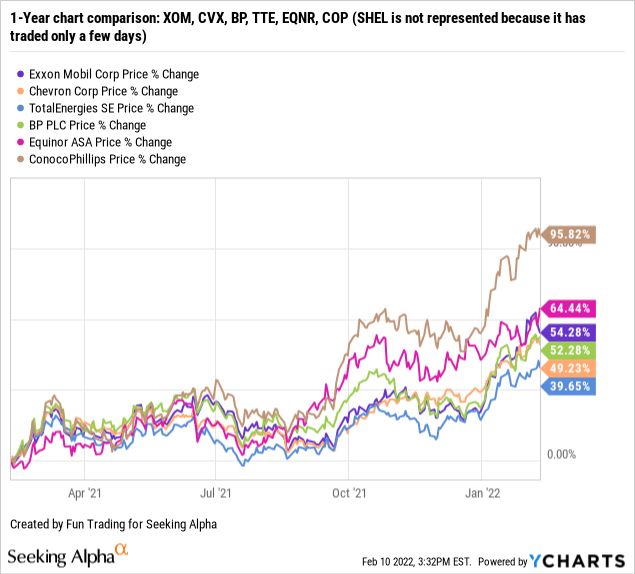

Exxon Mobil Stock Q4 And Full Year 2021 Complete Analysis Nyse Xom Seeking Alpha

Exxon Mobil Corp Advanced Charts Xom Barron S

Exxon Mobil Stock Q4 And Full Year 2021 Complete Analysis Nyse Xom Seeking Alpha

Exxon Mobil Corp Advanced Charts Xom Barron S

Exxon Mobil Corp Advanced Charts Xom Barron S

Exxon Mobil Corp Advanced Charts Xom Barron S

/BRK.A_2022-04-27_18-03-27-dc0f747f92f3469296b84c9f449fadf1.png)

Berkshire Hathaway Earnings What To Look For From Brk A

Exxon Mobil Corp Advanced Charts Xom Barron S

Exxon Mobil Corp Advanced Charts Xom Barron S

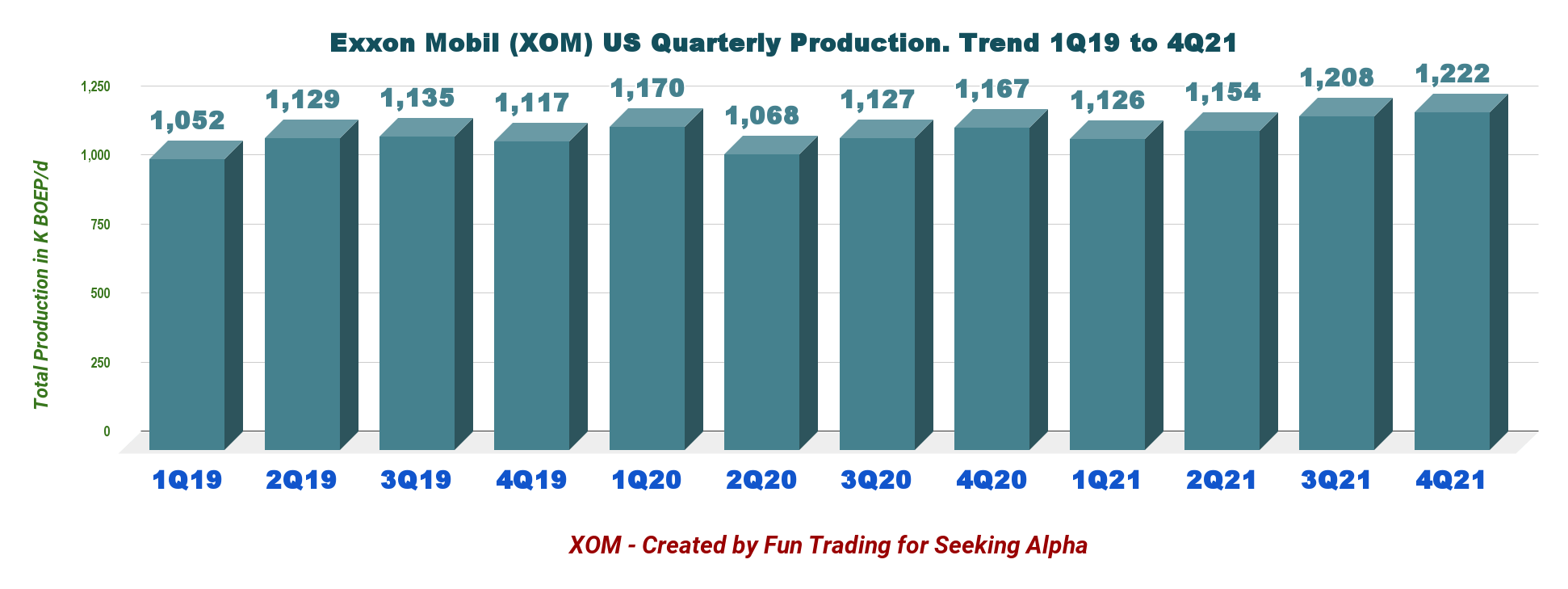

Exxon Mobil Stock Q4 And Full Year 2021 Complete Analysis Nyse Xom Seeking Alpha

Exxon Mobil Stock Q4 And Full Year 2021 Complete Analysis Nyse Xom Seeking Alpha

Exxon Mobil Stock Q4 And Full Year 2021 Complete Analysis Nyse Xom Seeking Alpha

Noteworthy Etf Inflows Vti Brk B Xom Cvx Nasdaq

Exxon Mobil Corp Advanced Charts Xom Barron S

Exxon Mobil Corp Advanced Charts Xom Barron S

Exxon Mobil Stock Q4 And Full Year 2021 Complete Analysis Nyse Xom Seeking Alpha

Comments

Post a Comment